In Cool Roof, the terms DSRA, ESG, but also ESRS, EFRAG, IRO, NFRD have invaded our social networks, email boxes and coffee breaks. And it is assumed that this is the case for you too ! But what is there, exactly ? Cool Roof explains what it is, and how to its solutions of cool roofing improve your impact ESG, your IRO, your transition plans… The answer is 10 little words : The CoolRoof generates operational impacts are carried forward in the ACCOUNT. As well, we will accompany you in your process of transition economic, environmental and social, while supporting your compliance.

The DSRA is a revolution in the way companies manage their responsibilities to environmental and social. Although the challenges are many, solutions to prepare effectively. In Cool Roof, we are convinced that the transition to sustainable practices is an opportunity. By adopting our solutions and integrating their data ESG in your sustainability report, you will comply with not only the legislation in force, but you will strengthen your commitment towards a more sustainable future. Or greenwashing, or speculation on the price of carbon ; the CoolRoof to effectively mitigate your impact on the environment and society.

In this article, we suggest you review the ins and outs of the DSRA, and then discover how to Cool Roof accompanies you in the preparation of your transition plan and your sustainability report with its solutions of cool roofing.

This January 1, 2025, the first companies subject to the DSRA (Corporate Sustainability Reporting Directive) have published their sustainability reports, disclosing the extent of their impacts ESG (Environmental, Social and Governance) and their transition plans.

Year by year, an increasing number of companies publish a sustainability report in parallel of their management report. This practice became a requirement under the NFRD, but is strengthened and standardized by the DSRA. This directive of the european Union since been transposed into French law, is a new legislation that we impact all and all, professionals and individuals. Adopted by the EU in December 2022, it is officially in the year since January 1, 2024.

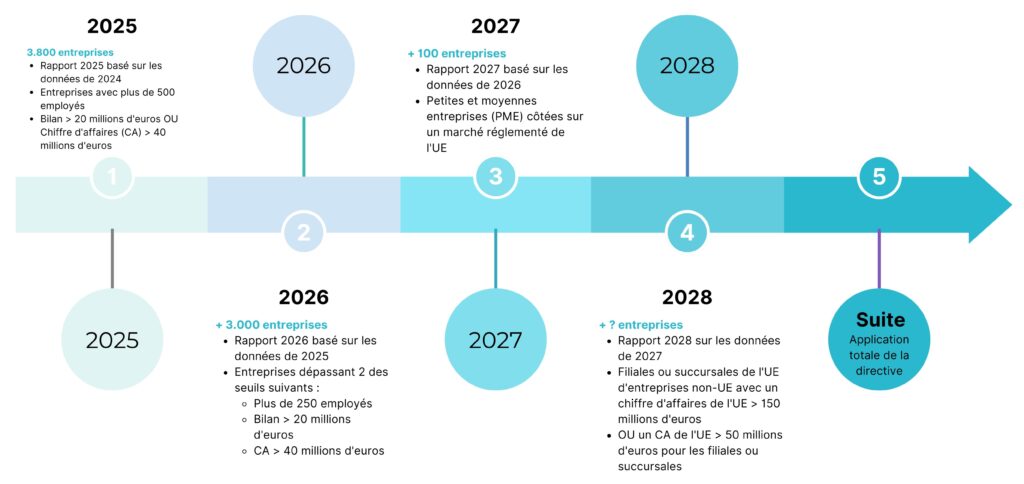

Up to now, the DSRA was only for very large european companies. But, as we shall see it together, new companies are affected each year until 2028. Therefore, it is crucial for all of us to understand this new legislation and to anticipate the requirements and consequences. Because the DSRA marks an important step in the standardization of the reporting of ESG across the european Union.

First, it is important to remember that the DSRA is deployed in several phases, depending on the size of the business. Three criteria dictate who is concerned and when : the staff, the balance sheet and sales. Using these criteria, four phases can be distinguished in many fields of application :

Companies with more than 500 employees, with a balance greater than 20 million euros, or a turnover of more than 40 million euros have published their first reports conform to the DSRA the 1er January 2025. These reports cover data for the year 2024. These companies are already subject to the NFRD.

The duty extends to companies with more than 250 employees, with a balance greater than 20 million euros, or a turnover of more than 40 million euros. They will publish their first reports conform to the DSRA the 1er January 2026. These reports will focus on data from the year 2025.

Inclusion of the listed SMES on the regulated markets of the EU. They will publish their first reports conform to the DSRA the 1er January 2027. These reports will focus on data from the year 2026.

Application to subsidiaries or branches of international groups operating in Europe, completing one of the following criteria : the international company achieves a turnover of more than 150 million euros in Europe, or the subsidiary or european branch of an international company achieves a turnover of more than 50 million euros. They will publish their first reports conform to the DSRA the 1er January 2028. These reports will focus on data from the year 2027.

Even if a company does not have to submit a report DSRA by January 1, 2028, it can be affected and impacted by the new directive. Because, to the extent that a report DSRA must disclose all of the impacts of ESG business, on the whole value chain, more small businesses involved in this chain (as a supplier, for example) are in the obligation to share their own data ESG with the company, which is currently submitted to the DSRA (unless an exception is justified).

These data ESG do not necessarily need to be formatted in a sustainability report in full by the small business, but they must in any case be communicated to the customer subject to the DSRA, which will then include in its sustainability report.

To make it simple, the DSRA replaces the NFRD (Non-Financial Reporting Directive). Its main purpose ? Raise the extra-financial reporting (also called ” extra-accountant “) to the same level of requirement and importance that the reports of traditional management. To do this, the ACCOUNT is designed to make the reporting of CSR (Corporate Social Responsibility) more available, rigorous, comparable and harmonized across the european Union. How? Based on many of the directives and laws, previous, and mobilizing hundreds of indicators and data.

Concretely, this means that companies will have to publish every year ESG-related data, standardized and quality, in the form of a sustainability report, thus allowing an increased transparency on the impacts of their activities.

The long-term, it is a law that will encourage the flow of capital to turn to activities that are sustainable. As, the publication of more rigorous of these information will guide the choice of financial markets and consumers – thus accelerating the ecological and social transition to a fairer Europe.

The DSRA is not born from the last rain – or the last hurricane in the Caribbean. Even if the directive itself is not in a financial year from 1 January 2024, it is part of a european legislative framework broader aim to achieve carbon neutrality by 2050.

It is part of the Package to Finance Sustainable of the EU. It contains a large number of european directives and national laws of the member States relating to the reporting of financial and extra-financial. In fact, the DSRA changes 4 previous directives : the Accounting Directive, the Transparency Directive, the Directive and Audit Regulation Auditing. In France, it is transposed via the order 2023-1142 and the decree 2023-1394 both of which align the frameworks of CSR commitment in the code of commerce in particular.

The sustainability reports, therefore, are not a novelty in Europe and in France. However, until evidence to the contrary, the level of requirement introduced by the DSRA is globally unique, given the amount, the quality and detail of the information to be published and its ambitions techniques in the medium and long term.

In fact, the DSRA and its new obligations do not stop at the mere enunciation of a “wish list” well-thinking. In order to deliver results, it introduces an essential principle : the analysis of the double-materiality. The double-materiality determines the information that the company must publish. It requires the company to analyze the impact of sustainability issues on the activities of the company, but also to analyze the dynamic inverse, that is to say, the impacts of the company on sustainability.

Thus, this concept requires an assessment at two levels :

Let’s take a very simple example. If your company produces wood furniture, you will need to answer questions in the “double-meaning” of this type : Is that your business is threatened by deforestation ? Your answer will identify the materiality financial. And vice versa, is your business contributing to deforestation ? This time, it will be a question of the materiality of the impact.

The double materiality requires companies to integrate ESG risks into their strategy, but also to think about their own impact on the world around them.

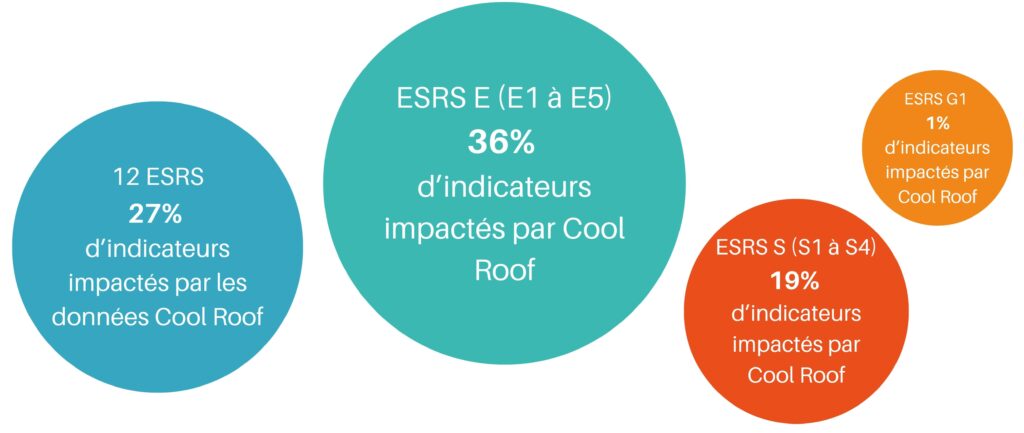

Twelve technical standards referred to as ESRS (European Sustainability Reporting Standards) and hundreds ofindicators identify the information to be published to comply with the law. Companies must render accounts of their means of implementation of these standards and of the results obtained, and then have it certified by an ITO (independent third party). This done, they publish a sustainability report, on time and in accordance with the requirements DSRA.

For more details about these mysterious indicators, continue to read our article – it’s coming soon !

Moreover, in order to ensure compliance with these new requirements, a system of sanctions has been put in place. In France, they include the appointment of a proxy external, fines (30k to 50k euros) and imprisonment (2 to 5 years). To learn more on this subject, we invite you to refer to the Portal CSR of the government.

For professionals, the DSRA represents a real turning point. It applies progressively from 2024, with the obligations growing according to the size and activity of the companies. This January 1, 2025, the large companies (over 500 employees) are already subject to the NFRD have published their first sustainability report in compliance with the requirements of the DSRA. By 2028, the directive will also SMES listed on the regulated markets of the EU and the subsidiaries of major international companies operating in Europe.

The impact of this commitment will be multiple, both in-house and on the markets. Once these data ESG published, the companies will demonstrate their competitors and the public that they actually contribute to the ecological transition and social justice.

For individuals, the DSRA is a real breakthrough of the right to information. As a citizen and consumer, you can access freely to the data published by the european companies. You can evaluate the concrete actions that they put in effort for you to also contribute to the ecological transition and social justice – and the better you identify in your everyday choice.

Beyond solidify the requirements of ESG in Europe, this directive is also a platform for four technical objectives

technical Objective #1 – The enthronement of the double materiality as a guiding concept for the reporting of ESG at the european level (as described above) ;

technical Objective #2 – The convergence of standards or the alignment of the many laws of the EU and its member States, on the disclosure of information by the private sector. At present, the Pact Green for Europe, the SFDR (Regulation on the disclosure of financial information related to sustainability), the Taxonomy of green and the Duty of vigilance of europe – not to mention all the national standards of the…

technical Objective #3 – The audit information or the obligation of certification data ESG companies by OTI. It is to ensure the veracity of the information, and to signify the importance of sustainability reports, in the same way that the management reports.

Technical objective #4 – The scan reports, that is to say that the companies are encouraged to adopt automation solutions for the collection, analysis and communication of data, ESG. Moreover, a Taxonomy european digital is expected in the years to come to pass incentives to the obligation to digitize reports DSRA.

The DSRA does not merely impose the publication of data as ESG, she structure the information according to the strict standards : the twelve ESRS (European Sustainability Reporting Standards).

We consider first the two standards “ cross-sectional ” :

Then come the ten standards “ themes ” are divided into 3 categories :

standards thematic themselves are then divided into sub – and sub-sub-themes. These standards allow companies to structure their report in a consistent manner and to respond to legal requirements.

These twelve standards have generated a certain degree of anxiety within companies, to the extent that these and indicators that would allow them to measure their compliance appeared to be ” hidden “ in the texts of law.

It is for this reason that theEFRAG (European Financial Reporting Advisory Group), a non-governmental organization, has been tasked by the EU to develop implementation guides from the technical standards contained in the directive. His mission was to organize and facilitate the implementation of the DSRA for the companies concerned.

One of the tools put in place by the EFRAG to facilitate the compliance of businesses is a table of recommended indicators for each of the ESRS. Thus, each company is guided in its evaluation of the impact of four levels : governance, strategy, management IRO (impacts, risks and opportunities) and the measures and targets.

In short : no ! More than 1000 indicators have been proposed by the EFRAG to measure the impacts of ESG companies. On this list, every company is obliged to publish approximately 170 data points (that is, the MDR), Minimum Disclosure Requirement), and can release up to more than 640 points of additional data.

The exact number of data points added is determined by the analysis of materiality. The data are to be published if the activities of the company are affected by the indicators in question. The official Journal of the EU is very clear on this point. When a company considers, after evaluation, that the theme of an ESRS is not important in view of its activities, it can remove the technical standard of its report after justification and certification.

The peculiarity of the data to be published is their nature mostly qualitative. More than 70% of the indicators that call for qualitative data (content, “narrative” or “semi-narrative” according to the european legislation), and less than 30% call to quantitative data (values of percentages, mass, monetary).

Therefore, it is particularly difficult for companies to implement the collection of qualitative data, to the extent that the production and analysis of qualitative data are much more arbitrary that the production and analysis of quantitative data. The EFRAG simply states that qualitative data can, for each indicator, mandatory, or relevant, to go from one paragraph to a hundred pages, without any restrictions.

In the light of all these requirements and possibilities of empirical evidence, the sustainability report imposed by DSRA involves the collaboration multiple actors within firms. As in the case of an annual report, the management and the directions of administrative and financial mobilized. But it is also and above all directions CSR and HR who are in the front line. Depending on the size of the company, those directions will have developed a certain expertise in the compilation of data ESG in previous sustainability reports, pre-DSRA.

A fear that dates back regularly on the networks is that of the DSRA man-eater : hundreds and hundreds of data to compile by dozens and dozens of people… Of data to identify and analyze, pages and pages to write… And, once the report is completed, the company is required to do audit. It means to entrust it to an auditor of sustainability.

Compliance with the DSRA poses three challenges to businesses :

At first, this may seem very expensive and time-consuming. Of course, the first report will probably be a source of stress considerable for each company. However, the objective of the DSRA is precisely constrain the actors and markets to contribute to a public good double : the mitigation of, and adaptation to climate change and its potential socio-environmental. In addressing these new challenges, the internal processes businesses transform and ESG issues as a major influence on their business model and strategy.

With the european harmonisation of the reporting ESG, it’s a whole world up until now emerging and established. New opportunities are to be seized, relationships to build, and new areas of trade building.

In the short-term, the requirements of the DSRA will encourage companies to put in place strategies for immediate results. The goal will be to reduce the impacts of ESG negative as quickly and as simply as possible. The sorting of waste, the use of straws in the paper, the elimination of touillettes plastic… It speaks to you ? But, in the medium-term, the DSRA should push companies to develop real strategies for reducing impacts of ESG – if these had not yet been put in place.

The coolroofing is part of the effective strategies to adopt in the face of today’s challenges, whether they be environmental, social or legislative. The functioning of the cool roofing has numerous benefits, discover here – and improves effectively the impacts of ESG buildings. Adopt solutions such as the coolroofing is a way to strengthen the adaptation of your business to climate change, to be able to measure it, and strengthen your compliance to the obligations DSRA.

In Cool Roof, we guide your step reporting by providing you with qualitative and quantitative data on the impacts of ESG of our solutions. Our roof coverings, designed to reduce the heat absorbed by buildings, can directly contribute to your sustainability goals.

In accordance with the DSRA, you include in your reports of durability the data quantified and certified by the Cool Roof, such as :

These data may feeding the assessment of the impacts of ESG for the ESRS E and the ESRS S in particular. A list of specific indicators for which data from Cool Roof can be useful is available on request.

The cool roofing is a solution particularly suited to companies that want to commit later in the transition environmental and social, and then be able to quantify the impact of its commitments. Regardless of their primary goal of diversification of a CSR strategy pre-existing or new policy of compliance with the DSRA – these companies will be able to use this technical décarbonation and get results that are measurable and verifiable, right after its installation.

Or greenwashing, or speculation on the price of carbon ; the CoolRoof to effectively mitigate your impact on the environment and society. Contact us today to discuss all of your projects of energy transition !

The DSRA is a european directive aimed to harmonise the reporting of ESG. It requires businesses to disclose detailed information and standardized on their environmental and social impacts in the “sustainability reports” and aims to raise it to the rank of management reports.

The implementation is progressive, with bonds starting at 1er January 2025 (submission of reports on the data of the year 2024) for large companies, and then gradually extending to SMES and subsidiaries of international groups until 2028.

The cool roofing can improve your impact ESG thanks to its many benefits. Among other things, it reduces the carbon footprint of your buildings and provides auditable data for your reports ESG, thus facilitating compliance with the standards of the DSRA. Or greenwashing, or speculation on the price of carbon : the CoolRoof is a proven solution that delivers tangible results and measurable once the installation is complete.

The double materiality is to assess both the impact of a company on the environment and society (materiality of impact), as well as the influence of sustainability issues on its activities (materiality financial). The analysis of double-materiality allows the firm to determine what information it must publish in order to be in compliance with the DSRA.

In France, the non-compliant companies face fines, the designation of an outside party, or even jail time in some severe cases.

Even if you are not directly concerned, the DSRA could you reach through your customers or business partners. In fact, the DSRA requires that each company that it considers the impacts of ESG of the entire value chain. The companies involved could lead to having to share their own data ESG with their partners. Also, anticipate this directive can help you stay competitive.